Remember pausing in the store when a recognized brand’s price tag suddenly rose? Remember the exhilaration you felt when concert tickets rose overnight? The intense pull between what you desire and what you can afford makes price quantity demanded real in reality, beyond economics. Sit down as we study this intriguing topic, elasticity of demand.

In economic terms, it implies your restless mind attempts to discern necessity from desire when you purchase components or medicines. It’s like being stranded in the perishables department, covering the elevator to hike honey prices.

Setting the Stage: What Is Elasticity of Demand?

Price elasticity of demand measures the degree to which consumers respond to price shifts. It is a comparison of the percentage change in quantity demanded with the percentage change in price:

Elasticity= % Δ Qd% Δ PElasticity= % ∆ Qd% ∆ P

- If “elasticity > 1, demand is elastic (quantity changes more than price).”

- If “elasticity < 1, demand is inelastic (quantity changes less than price).”

- If “elasticity = 1, demand is unitary elastic (proportionate change).”

In simple terms: How much does the average consumer change their buying during price changes?

When Demand Stretches: Elastic Goods

Imagine a situation in which a hip-beanery in town raises its latte price by 20%. If customers grumble about the price and cut their weekly latte consumption by 40%, then the demand is elastic and hence responsive to increases in price. Luxuries, non-necessities, and things having close substitutes are those items that usually behave this way:

- Non-essential goods: Gourmet chocolates, high-end electronics, brand-name apparel.

- Substitute-rich markets: If a coffee chain tries to hike the prices, then buyers just switch to another outlet.

- Budget-conscious buyers: During such economic downturns, even the most mundane, everyday pleasures get subjected to heavy scrutiny.

Elasticity helps smart businesses experiment with pricing: loyalty programs, time-limited discounts, or tiered offerings can stir customers into buying for a slight increase in price.

When Demand Contracts: Inelastic Goods

Contrast that with a life-saving medicine whose price doubles in a single night. Decreasing dosages is the very last thing a patient would do if at all possible. Demand in this case is inelastic, with price increases rarely leading to a sizable drop in demand. Examples of inelastic goods include:

- Necessities: Basic food staples like rice or bread.

- Lacking substitutes: Unique prescription drugs, specialized industrial inputs.

- Habitual purchases: Strong brand loyalty (think your favorite toothpaste).

In the case of firms supplying such goods, downward sloping demand is synonymous with pricing power, although most of the time, ethical norms or regulations impose ceilings upon prices.

Determinants: What Shapes Elasticity?

The reason behind inflation on certain things, with some things contracting, helps both policymakers and businesses. The key determinants include:

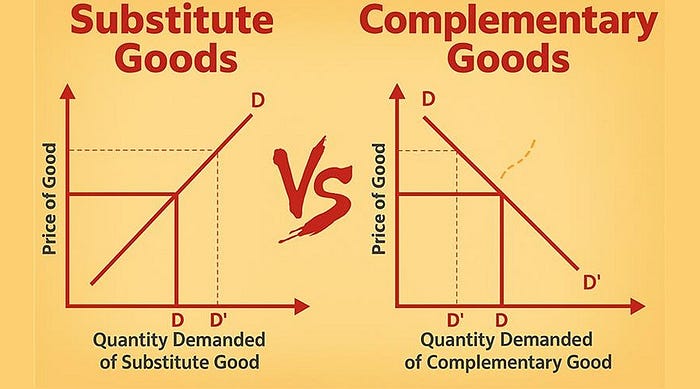

1. Availability of Substitutes

- More substitutes → higher elasticity.

- Fewer substitutes → lower elasticity.

2. Proportion of Income

- Items representing a large share of a consumer budget (rent, cars) tend to be more elastic.

- Tiny-ticket items (salt, chewing gum) tend to be inelastic.

3. Necessity vs. Luxury

- Necessities → inelastic.

- Luxuries → elastic.

4. Time Horizon

- Short run → demand often inelastic (habits are hard to change).

- Long run → demand more elastic as consumers find alternatives.

From Theory to Life: Real-World Vignettes

- Gasoline and Commuters: Short-term adjustment in gasoline demand is relatively inelastic. In the short run, drivers cannot suddenly switch to an electric car. Over the years, a higher price for gas also incentivizes fuel efficiency and conveys passenger transportation, which increases its elasticity in the long run.

- Airline Tickets: Late bookings for holiday flights value prices: leisure travelers can just change schedules, making all late demand elastic. Now look at the business travelers booking months in advance-they are inelastic in their flight-buying behavior, which gives rise to frequent-flyer price levels.

- Streaming Subscriptions: Subscription fees rise, while the casual users tend to cancel niche services (elastic demand), the true fans or connoisseurs of exclusive content stay committed to it (inelastic demand), thereby modifying the strategy by which platforms bundle and price their services

Why Elasticity Matters

- Businesses set prices as the last step in revenue maximization; a price increase on inelastic goods can improve margins, while a price decrease on elastic goods can increase volumes.

- Governments assess tax policies; imposing heavy duties would reliably raise revenues and, at the same time, reduce consumption given the inelastic demand for cigarettes.

- Consumers gain insight into spending habits; recognizing elasticity helps budget for staples versus splurges.

During my consulting career, very early on, I advised a regional bakery on a 10% price increase. We had elasticity estimates from some local surveys. The prediction was just a 2% drop in sales. That is, understanding demand curvature can actually give you the kind of confidence on which to base a well-informed decision.

Concluding Stretch: The Price Tag’s Elastic Tale

Elasticity of demand is far beyond a mere classroom formula-it is an ever-active narrative between producers and consumers, expectations and realities. On account of the elasticity of demand, whether setting prices, drafting fiscal policy, or making purchases, your strategies and intuition can be sharpened.

So, as you ponder over a price, just know that you are not just buying a product; you are engaging in an intricate economic dance that stretches the boundaries of value and choice. This, dear reader, is the unusual and fascinating tale of elasticity of demand.

Academic scholars exploring the curious case of demand elasticity can boost their research with expert guidance. Get reliable publication support and precise synopsis writing to present your findings with confidence. Start shaping your academic success today with professional assistance!

FAQ’s

1. What is the difference between elastic and inelastic demand?

Price changes significantly impact customer demand (elasticity > 1). In contrast, inelastic demand is less affected by price fluctuations (elasticity < 1).

2. Why is the elasticity of demand important for businesses?

Products’ prices important. Elastic demand may restrict higher-price revenue. With inelastic demand, price hikes maximize profits and minimize customer loss.

3. Can a product’s elasticity change over time?

Yes. Demand becomes elastic when substitutes are created or consumer behaviors shift..

4. How does elasticity affect tax policy?

Higher taxes on inelastic items like tobacco and petrol do not diminish consumption, so governments may generate stable income.

Comments