Understanding the importance of position sizing is fundamental for any forex trader aiming to manage risk effectively and optimize trading performance. A lot size calculator is a specialized tool that helps traders determine the precise amount of currency units to trade based on their account size, risk tolerance, and stop-loss parameters. This tool ensures that traders do not expose themselves to excessive risk on any single trade, thereby protecting their capital and enhancing the potential for consistent profitability.

How a Lot Size Calculator Works

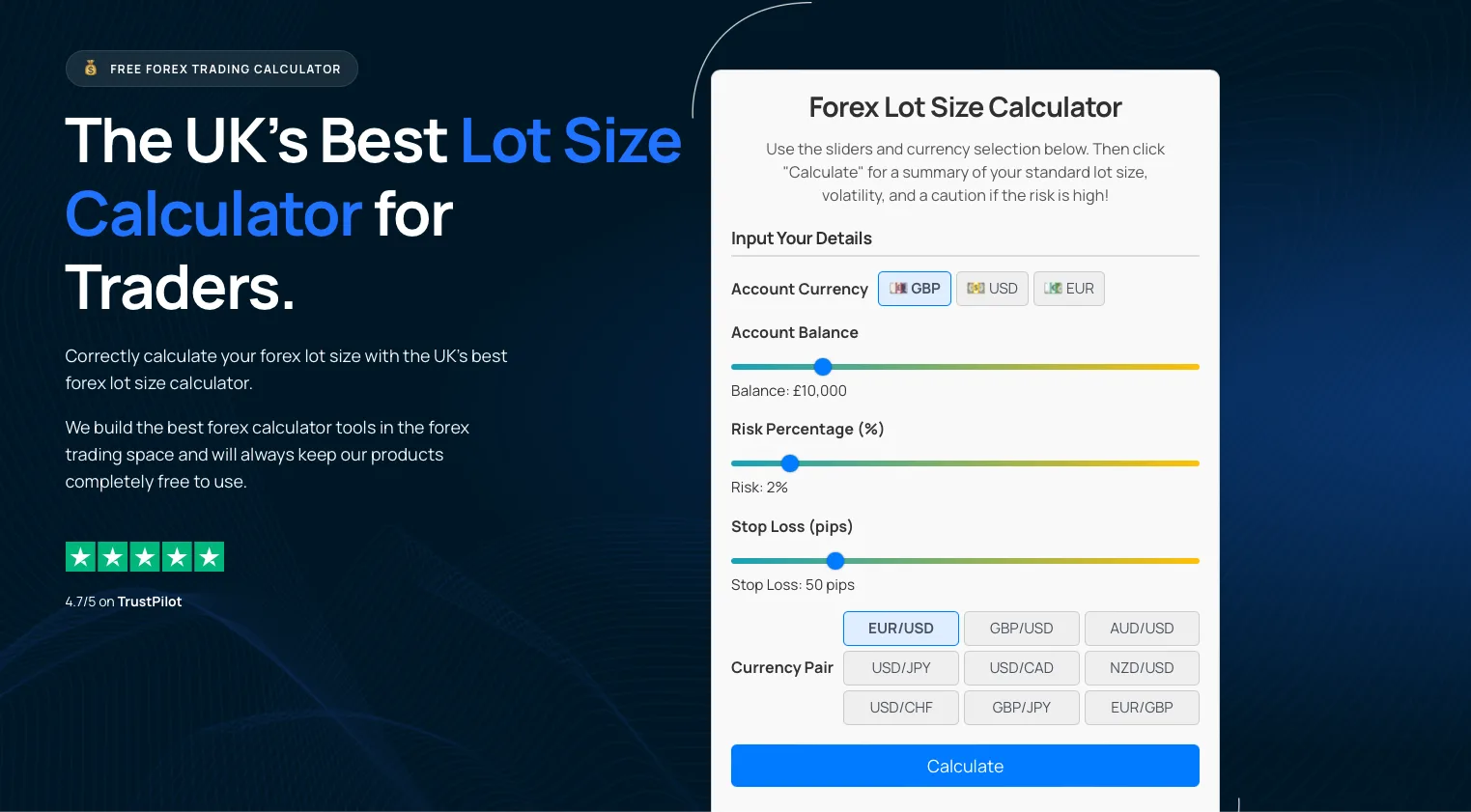

At its core, a lot size calculator uses a simple yet powerful formula that incorporates the trader’s account balance, the percentage of capital they are willing to risk, the stop-loss distance in pips, and the pip value of the currency pair being traded. By inputting these variables, the calculator outputs the optimal lot size for the trade. This calculation helps traders align their trades with their risk management strategy, ensuring that losses are limited to a predefined portion of their capital, regardless of market volatility.

Benefits of Using a Lot Size Calculator

The primary advantage of using a lot size calculator is precise risk control. Traders can avoid over-leveraging and prevent significant drawdowns by sizing their positions appropriately. Additionally, the tool saves time by automating complex calculations, allowing traders to focus more on market analysis and strategy execution. It also supports discipline by enforcing consistent risk parameters, which is crucial for long-term trading success. Moreover, many calculators are versatile enough to handle different instruments beyond forex, such as precious metals like gold and silver.

Integration with Trading Platforms

Modern lot size calculators often integrate seamlessly with popular trading platforms such as MetaTrader and TradingView. Some advanced tools, like the Magic Keys system, offer automatic lot size calculations combined with trade management features such as setting break-even points and partial take-profits. These integrations enhance trading efficiency by automating routine tasks and providing real-time position sizing based on live market data, which reduces errors and improves execution speed.

Customization and Advanced Features

Many lot size calculators allow traders to customize inputs according to their specific trading style and risk appetite. For example, users can specify risk as a percentage or a fixed amount, adjust stop-loss levels dynamically, and even account for leverage and margin requirements. Some expert advisor tools enable traders to drag entry and stop-loss lines directly on the chart to instantly update position sizes. Advanced calculators may also provide risk-to-reward ratios, margin requirements, and support multiple take-profit levels, offering a comprehensive risk management solution.

Practical Application in Risk Management

Effective use of a lot size calculator is a cornerstone of sound risk management in forex trading. By determining the correct position size before entering a trade, traders can ensure that no single loss will significantly damage their trading capital. This approach promotes emotional discipline and reduces the temptation to deviate from the trading plan. Furthermore, it allows traders to scale their trades proportionally as their account grows, supporting sustainable growth and capital preservation.

Conclusion: Empowering Traders with Precision and Confidence

A lot size calculator is an indispensable tool for forex traders who seek to control risk and trade with confidence. By providing accurate position sizing tailored to individual risk preferences and market conditions, it helps traders maintain consistency and avoid costly mistakes. Whether integrated into trading platforms or used as standalone tools, lot size calculators empower traders to make informed decisions, safeguard their investments, and ultimately enhance their chances of long-term success in the highly volatile forex market.

Comments